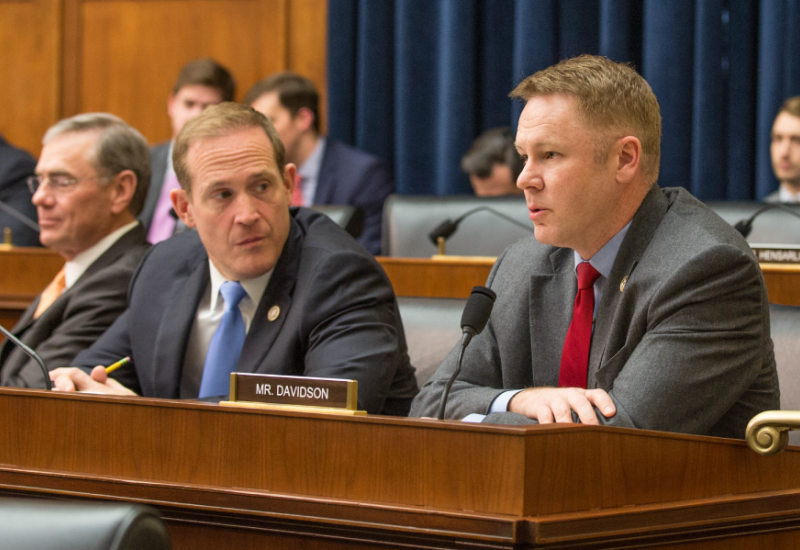

Warren Davidson, the US Rep. has announced plans to introduce new legislation in the US Congress. The planned legislation would regulate both the Initial Coin Offerings {ICOs} and the federal cryptocurrencies. This was according to a news piece that was reported in the Cleveland.com, a local Ohio news agency.

Creating An Asset Class For The Cryptos

It was at the Blockchain Solutions Conference where Davidson announced this new intention. The planned new legislation would introduce an asset class for the cryptos and other digital assets. As a result of this, the cryptos would not be classified as securities. In addition to that, the new legislation would give the federal government some new powers. The federal government would now be able to regulate the Initial Coin Offerings {ICOs} in a more effective manner. There has been so much going on in the whole issue of cryptocurrency regulation in the US. However, with this new piece of legislation, much clarity concerning the issue would be brought forward. At the moment, the tokens are classified differently by state regulatory bodies. It is mainly done in ways that put them in their own jurisdiction.

How Cryptos Are Treated By Various Agencies

There are two main agencies that have been actively involved with the issue of crypto classification and regulation. They are the Securities and Exchange Commission and the Commodity Futures Trading Commission. Both of them have a different stance in regards to the classification of the cryptos. The Securities and Exchanges Commission hold it that a number of the virtual coins are securities. On the other hand, the Commodity Futures Commission classifies the virtual coins as commodities.

Other Views From Various Agencies

CFTC believes that Bitcoin has so many similarities with gold than with securities and currencies. This is because it is not backed by a state and doesn’t have liabilities connected to it. The cryptos are also viewed differently by the Anti-Money Laundering agency, the Financial Crimes Enforcement Network, and know your client standards. They also regard the virtual coin as money. The U.S Office of Foreign Assets Control also views the crypto as money. However, this body that enforces economic sanctions blacklists the wallets of sanctioned individuals. The cryptos are also treated as property by the Internal Revenue Service – IRS. This implies that the profits for selling them are subject to the tax of capital gains.

Clearer Guidelines Needed

In September 2018, a group of the US Congressional representatives wrote to Jay Clayton, the SEC chairman. In the latter, they asked for clearer guidelines between the cryptos that have been classified as securities. The same month saw close to 50 major crypto firms representatives attend a Congressional roundtable discussion. The discussion that was also attended by the Wall Street companies discussed ICO and crypto regulation. The meeting was hosted by Warren Davidson, who has been at the forefront of all this. The experts present expressed their great concerns on the absence of the regulatory clarity. They also discussed the token taxonomy issue.