The two leading forces within the Western world have both pulled the reins even tighter with regards to financial legislation, in order to showcase the pathway for global economic growth. However, the realities of possible armed conflicts, questions over the legitimacy of fiat currency thanks to the strength of Cryptocurrencies and instability in governments remain as heavy talking points.

The Predictions Made By Analysts

Analysts are predicting that the US Federal Reserve Bank will most definitely be moving to hike up interest rates come Monday morning in order to show a more balanced slate for political policy within the nation. Moving across the ocean to Europe, the European Central Bank or ECB will be announced as of Thursday that its €2.55 trillion bond act will be in its final stages and soon laid to rest. Both of these actions should be a signal to the world and the markets that the world is entering out of, or rather attempting to enter out of a phase of mayhem.

These actions have taken place at the same time may be just a coincidence, but their almost simultaneous occurrence sees a bigger change in the fundamental way that markets are run. The simultaneous occurrence of these actions leads to the suggestion that the time for central banks within nations to steer the financial policy of a nation is coming to an end. This act also tells analyst two things, firstly that economies are at a stage where they are able to operate without being guided and secondly, that central banks would like to have less input within the financial market in case the looming financial collapse materializes.

The ECB faces a tough road ahead as the benefits of the €2.55 trillion bond within the European Union have been unparalleled. Over the last five years, citizens have been basking within an economy of abundance, with a surge in employment opportunities, a clear growth in wages and with low interests on bonds and other debts. However, the likely thing that must happen should the program end be announced this coming Thursday is for the interest rates within the banks to begin climbing again, until market forces are able to counterbalance it, so that a new equilibrium may be reached.

The ECB faces a tough road ahead as the benefits of the €2.55 trillion bond within the European Union have been unparalleled. Over the last five years, citizens have been basking within an economy of abundance, with a surge in employment opportunities, a clear growth in wages and with low interests on bonds and other debts. However, the likely thing that must happen should the program end be announced this coming Thursday is for the interest rates within the banks to begin climbing again, until market forces are able to counterbalance it, so that a new equilibrium may be reached.

The Nail In The Coffin

There is one little problem with that though, the ECB made a clear promise to the public that the low-interest rates that helped to propel this period of abundance into existence will continue to be held in place for a long time after the project had come to an end. Most analysts are expecting for the ECB to propose a strategy whereby interest rates will be increased slowly by approximately 2% at a slow but stable cycle over a few years or quarters until the desired interest rate is reached.

The Role Of Cryptocurrencies

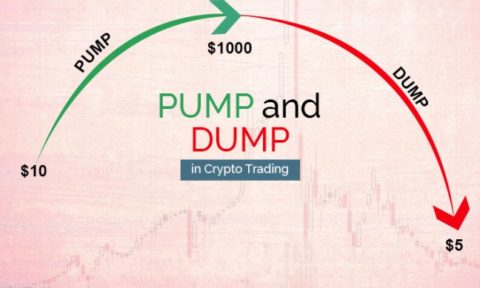

What does this all mean for Cryptocurrencies? Well, the fact that central banks are choosing to step slightly back from their nations economic affairs shows that the decentralized model of Cryptocurrencies has been highly effective and this message may have influenced public opinion to such an extent that it has affected the banks actions. What do you think the edging away of central banks from financial policies holds for Cryptocurrencies, will it allow for greater involvement of Cryptocurrencies or have the analysts read too much into it too soon?